To All Our Stakeholders

From left: Kunio Noji, Chairman of the Board and Tetsuji Ohashi, President and CEO

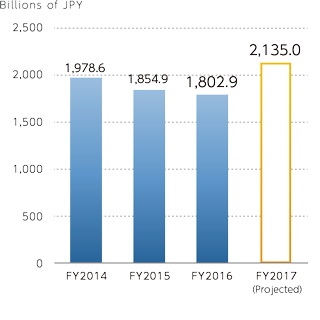

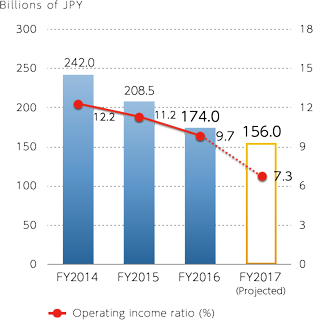

For Fiscal 2016 (April 1, 2016 to March 31, 2017), while we outperformed our projection of April 27, 2016, concerning both sales and profits, consolidated net sales declined 2.8% from the previous fiscal year, to JPY1,802.9 billion, and operating income by 16.5% to JPY174.0 billion.

For Fiscal 2017, we can expect recovery of demand for construction and mining equipment, although there should be unstable factors. Against this backdrop in April this year, we closed the acquisition of Joy Global Inc., a leading manufacturer of mining equipment in the United States, and changed its trade name to Komatsu Mining Corp.

The cornerstone of our management principles is to maximize our corporate value through commitment to Quality and Reliability. We will also ensure that all employees share The KOMATSU Way. Further, we will continue to address environmental performance, corporate social responsibility and corporate governance, as we work to improve our business performance and move forward in developing corporate strengths, while achieving social responsibility, in a well-balanced manner.

On behalf of the Board, we would like to extend our sincere appreciation to our shareholders and other stakeholders for your continuing support.

July 2017

Kunio Noji,

Chairman of the Board

Tetsuji Ohashi,

President and CEO

Interview with the President

Tetsuji Ohashi, President

Please review FY2016 business results.

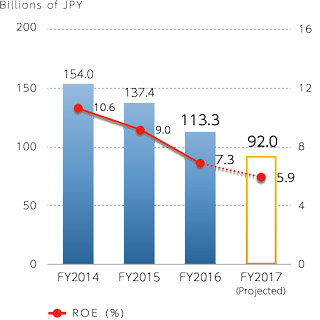

We have upheld the “Together We Innovate GEMBA Worldwide: Growth Toward Our 100th Anniversary (2021) and Beyond” three-year mid-range management plan to be completed in the fiscal year ending March 31, 2019. For FY2016, the first year of this plan, consolidated net sales totaled JPY 1,802.9 billion, down 2.8% from the previous fiscal year. Operating income decreased by 16.5 % from the previous fiscal year, to JPY 174.0 billion. Return on sales was 9.7 %. Net income attributable to Komatsu Ltd. amounted to JPY 113.3 billion.

Consolidated Business Results

Net Sales

Operating Income and Ratio

Net Income Attributable to Komatsu Ltd. and ROE

Foreign Exchange Rates

| FY2015 | FY2016 | FY2017 (Projected) |

|

|---|---|---|---|

| USD1 | JPY120.8 | JPY108.6 | JPY105.0 |

| EUR1 | JPY132.4 | JPY119.3 | JPY115.0 |

| RMB1 | JPY19.0 | JPY16.2 | JPY15.0 |

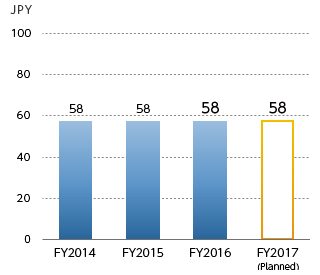

Cash Dividend

Annual Cash Dividends per Share*

* Based on the resolutions of the annual shareholders' meeting

Together We Innovate GEMBA Worldwide -Growth Toward Our 100th Anniversary(2021) and Beyond-

Komatsu Group employees worldwide will team up with distributors, suppliers and other partners, innovate customers' Gemba together with them, and provide innovation designed to create new values, thereby working for sustainable growth of our core businesses of construction and mining equipment, as well as industrial machinery, toward our 100th anniversary and beyond.

Please review the market conditions and business results of the construction, mining and utility equipment business.

Total sales increased on a local currency basis thanks to increased demand in China, CIS and Indonesia in the second half period of FY2016. As impacted by the Japanese yen's appreciation, however, FY2016 sales declined by 1.6% from the previous fiscal year, to JPY1,576.5 billion. Segment profit decreased by 4.3% to JPY161.6 billion.

Business Results by Region

Against the backdrop of challenging market conditions, sales declined in Japan as well as North America and Europe, where the Japanese yen's appreciation adversely affected sales. Meanwhile, sales expanded in China and Asia.

Please review the business results of the retail finance segment.

Revenues declined by 9.0% from the previous fiscal year, to JPY 49.0 billion, as adversely affected by the Japanese yen's appreciation, even though an increase in assets in North America and some other regions. Segment profit dropped by 66.6% from the previous fiscal year, to JPY 4.4 billion, mainly affected by allowance for doubtful account recorded mainly in China.

Please review the business results of the industrial machinery and others segment.

Sales declined by 13.2% from the previous fiscal year, to JPY 191.0 billion. This decline came about mainly from reduced sales of presses and machine tools to the automobile manufacturing industry and the exclusion of the former Komatsu House Ltd. from consolidated accounting. Segment profit dropped by 35.7% from the corresponding period a year ago, to JPY 12.4 billion.

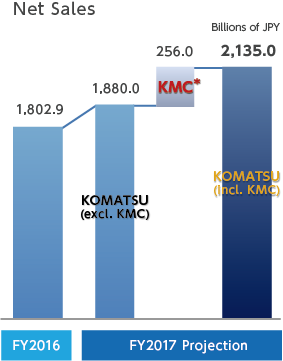

What is your projection for FY2017 business results?

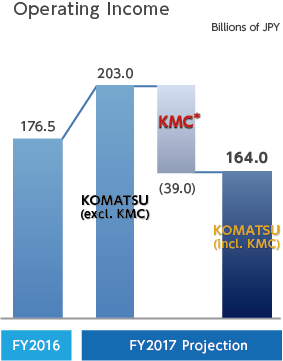

In the construction, mining and utility equipment business, we expect an increase in sales for FY2017 from FY2016, as we anticipate a recovery of demand for mining equipment, which has been slack for the last few years, and the effects of adding Joy Global Inc. (currently, Komatsu Mining Corp.), a leading U.S. manufacturer of mining equipment which we closed the acquisition in April this year, to our consolidated accounting. With respect to profits, we project a decline, mainly affected by a significant amount of temporary expenses (such as fair values of inventory assets in cost of sales and amortization of intangible assets) to record for the first year of acquisition.

In the retail finance business, we anticipate a decrease in revenues, affected by the Japanese yen’s appreciation. Meanwhile, we expect an increase in segment profit, as no more allowance will be needed for doubtful accounts in China.

In the industrial machinery and others business, we expect an increase in both sales and segment profit, as we anticipate an increase in the volume of sales of presses and machine tools.

As preconditions for our projection, we are assuming the foreign exchange rates as follows: USD1=JPY 105, EUR1=JPY 115 and RMB1=JPY 15.0.

Projection of FY2017 Business Results

*KMC: Komatsu Mining Corp.

Please update the progress Komatsu has made in three major growth strategies.

Although we see signs of recovery in some markets, they haven't upturned for full-momentum growth, remaining uncertain into the future. Under such a market environment, we have been focusing our efforts on 1) Growth strategies based on innovation, 2) Growth strategies of existing businesses, and 3) Structural reforms designed to reinforce the business foundation.

Please explain the growth based on innovation.

With respect to SMARTCONSTRUCTION, we have not only worked to broaden the range of intelligent Machine Control models, the core of solutions, but also began their sales in April 2016, whereas they were conventionally limited to rental. As of June 2017, our intelligent Machine Control models were deployed at over 2,800 construction and civil engineering jobsites on a cumulative basis. With an eye to aggressive sales overseas, we demonstrated SMARTCONSTRUCTION at the ConExpo2017, a major international fair of construction equipment held in Las Vegas, U.S.A. in March 2017.

In the mining equipment business, we exhibited the Innovative Autonomous Haulage Vehicle with no cab at the MINExpo INTERNATIONAL® 2016, a leading international fair of mining equipment also held in Las Vegas, U.S.A. We are striving to improve the safety and productivity of mining by aggressively promoting optimal operation, remote control and unmanned operation of mining equipment, thereby committed to becoming an indispensable partner of our customers.

SMARTCONSTRUCTION

This is our solutions business model launched to create safe, high-productivity and smart jobsites of the future by connecting all related objects on the jobsite through ICT.

Innovative Autonomous Haulage Vehicle

We have enjoyed good customer evaluation of our Autonomous Haulage System (AHS) with unmanned dump trucks since its commercialization in 2008. Today we are tapping into new potentials of innovation by breaking the convention of placing the operator cab on the front of the vehicle.

How about the growth of existing businesses?

In April 2017, we closed the acquisition of Joy Global Inc., a leading manufacturer of mining equipment in the United States, and changed its trade name to Komatsu Mining Corp. Now we are better positioned to not only expand our product line-up with super-large mining equipment, drills and underground mining equipment, but also provide a wide range of solutions to customers.

With regard to the integration process of Komatsu Mining Corp., we are developing specific plans in six months of the acquisition by anticipating about three years ahead. We believe it's a substantial project in which we can dynamically expand our mining equipment business, a long-range core business of Komatsu, and provide new value to customers.

In line with the current mid-range management plan, we have worked to establish the market position of DANTOTSU No. 1 in Asia, our stronghold market in emerging ones and a future-promising market for construction equipment. Specifically, we have focused efforts to strengthen our operation by preparing for local product and human resource developments in Asia. In the aftermarket business, we have stepped up efforts to expand sales of parts for periodic replacement and attachments. We have also worked to broaden the product mix of attachments, including those of Lehnhoff Hartstahl GmbH, a German manufacturer of attachments, which we acquired in the previous fiscal year. As a result, we achieved the record-high quarterly sales of parts in FY2016.

While focusing efforts to develop DANTOTSU products for conventional markets, we will also continue to strengthen our competitiveness in the aggregate and cement sectors, expand application-specific models, and boost the forest machinery business.

In the industrial machinery and others business, Komatsu Industries Corp. opened the Techno Innovation Center in Komatsu City, Ishikawa Prefecture, Japan. The Center not only exhibits Komatsu Industries' flagship PVS1353 press brake and H1F200-2 Servo press among others, but also offers visitors to experience its latest IoT-based Sheet-Metal Network.

Expanding business with Komatsu Mining Corp. (formerly, Joy Global Inc.)

On April 19. 2017, Komatsu Mining Corp. (KMC) was created after acquisition of the U.S. company. KMC is expected to not only further expand Komatsu Group's product line-ups but also trigger innovation that will create new value in customers' mining.

Asia Development Center and Asia Training & Demonstration Center opened

We have opened these development and training facilities to further focus our efforts on attaining the DANTOTSU No. 1 position in Asia.

Please explain the reinforcement of the business foundation.

We have doubled sales from the early 2000s, while keeping fixed costs about constant. We will continue to uphold the policy of separating costs from growth into the future, while promoting investment in future growth and working to aggressively cut down production costs and maintain an appropriate level of fixed costs.

With respect to shop floor of manufacturing sites, we are promoting efforts to reform our production by networking not only our manufacturing plants but also suppliers through the KOM-MICS which allows for real-time "visualization" of machine performance. We are also working to accelerate the delivery speed of products and parts and achieve appropriate inventories by connecting market information directly to our plants.

The corporate source of value creation is employees. As we believe that diversity powers the growth of our company and individual employees, we are committed to providing workplaces and systems which enable each and every employee of the Komatsu Group to have motivation and pride and demonstrate his/her talents to the fullest extent. We will also continue our efforts for human resource development.

KOM-MICS

KOM-MICS collects data from a diverse range of manufacturing equipment and promotes "visualization" of jobsite operations.

How do you think of the ESG?

The Komatsu Group has been aggressively engaged in all three areas of environment, social and corporate governance concerns.

With respect to environmental concerns, we have been concerting our efforts to develop products, service and solutions, which feature fuel economy based on our estimate that about 90% of total CO2 emissions in the life cycle of construction equipment comes from machines in use by customers.

Use of our intelligent Machine Control hydraulic excavators in SMARTCONSTRUCTION has proven a 20 to 30% reduction of CO2 emissions thanks to reduced time of machine operation and construction periods resulting from automatic control of buckets.

In the area of social concerns, the Komatsu Group upholds the principle of CSR efforts in core businesses, and makes CSR efforts in which we can capitalize on our strengths, thereby fulfilling social responsibilities. In some regions and countries of the world, acquisition of operating, maintenance and manufacturing skills of construction equipment will result in the development of local economies and support for employment. We will continue to support human resource development in tune with local conditions.

With respect to corporate governance, based on The KOMATSU Way, the principle of our corporate actions, we ensure the vitalization of the board of directors, communication with all stakeholders, and compliance with the Rules of Business Community, among others. Concerning the board of directors, we have appointed three outside directors in a total of eight directors. Our board of auditors consists of three outside auditors and two inside auditors. In this manner, we work to ensure the transparency and objectivity of management. As part of risk management efforts, we started compliance risk audits in FY2008.

Compliance Risk Audit

To check and assess the conditions of group-wide compliance and identify potential risks thereof, we conduct internal audits at Komatsu Group companies around the world, including distributors, their branches and suppliers in Japan.

Any message to the stakeholders?

On behalf of Komatsu Group employees, I would like to extend our sincere appreciation to all our stakeholders for their understanding and support, and ask for their continuing support.

Corporate Information

(As of March 31, 2017)

Outline

| Name | Komatsu Ltd. |

| Head Office | 2-3-6 Akasaka, Minato-ku, Tokyo 107-8414, Japan |

| Date of Establishment | May 13, 1921 |

| Common Stock Outstanding | Consolidated: ¥67,870 million based on U.S. GAAP Non-consolidated: ¥70,120 million |

| Number of Employees | Consolidated: 47,204 (Komatsu Ltd. and 141 consolidated subsidiaries) Non-consolidated: 10,371 |

Shareholder Information

| Shares of Common Stock Issued and Outstanding | 943,538,362 shares (excluding 28,429,298 shares of treasury stock) |

| Number of Shareholders | 158,453 |

| Number of Shares per Trading Unit | 100 |

| Securities Code | 6301 (Japan) |

| Stock Listings | Tokyo |

| Transfer Agent for Common Stock/Management Institution for Special Account | Mitsubishi UFJ Trust and Banking Corporation 4-5, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-8212, Japan |

| Depositaries (ADRs) | The Bank of New York Mellon 101 Barclay Street, New York, NY 10286, U.S.A. Tel: +1-(201)-680-6825 for international calls and 888-269-2377 (888-BNY-ADRS) for calls within U.S.A. URL: http://www.adrbnymellon.com Ticker Symbol: KMTUY |

Major Shareholders (As of March 31, 2017)

| Name | Number of shares held (Thousands of - shares) |

Shareholding ratio (%) |

|---|---|---|

| JP Morgan Chase Bank 380055 (Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

59,920 | 6.16 |

| Japan Trustee Services Bank, Ltd. (Trust Account) | 48,700 | 5.01 |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 41,336 | 4.25 |

| Taiyo Life Insurance Company | 34,000 | 3.49 |

| State Street Bank and Trust Company (Standing proxy: The Hongkong and Shanghai Banking Corporation Limited, Tokyo branch) |

30,928 | 3.18 |

| Nippon Life Insurance Company (Standing proxy: The Master Trust Bank of Japan, Ltd.) |

26,626 | 2.73 |

| State Street Bank and Trust Company 505223 (Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

20,265 | 2.08 |

| The Bank of New York Mellon as Depositary Bank for Depositary Receipt Holders (Standing proxy: Sumitomo Mitsui Banking Corporation) |

19,593 | 2.01 |

| Sumitomo Mitsui Banking Corporation | 17,835 | 1.83 |

| Japan Trustee Services Bank, Ltd. (Trust Account 5) | 17,740 | 1.82 |

| Notes: | 1) Shareholding ratio is calculated by subtracting treasury stock. |

|---|---|

| 2) Although the Company holds 28,742 thousand shares of treasury stock, it is excluded from the major shareholders listed above. |

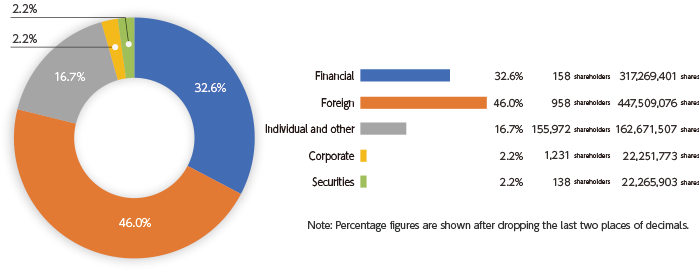

Breakdown of Shareholders