For Long-term Sustainable Growth

In 2021, we are going to celebrate our 100th anniversary. Komatsu, founded in today’s Komatsu City, Ishikawa Prefecture in 1921, has grown to become a Japan-based global company by committing itself to Quality and Reliability. For us to regard this anniversary as a milestone for sustainable growth into the future, we need to not only learn from the past but also look for management directions from a standpoint which is a lot longer term than ever before.

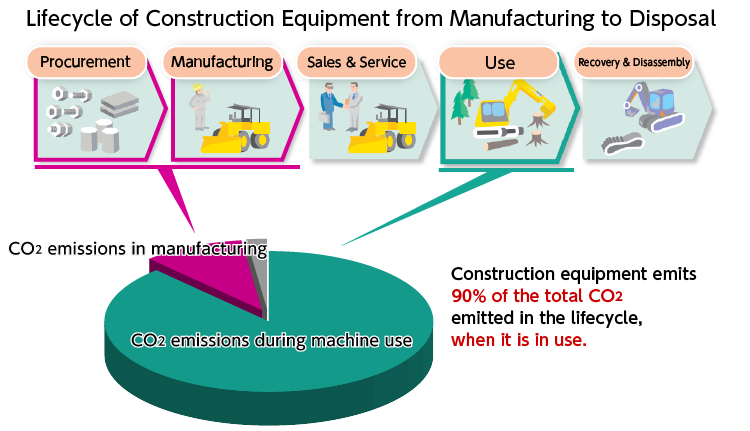

In emerging countries, we can look forward to growing infrastructure developments, such as roads, railways and water supply and sewerage systems, reflecting expanding population and accelerating urbanization. In developed countries, we can expect urgent needs to maintain the aging infrastructure while labor shortage will be getting more serious. As we are facing climate change, the reduction of environmental impact has become a more critical social issue.

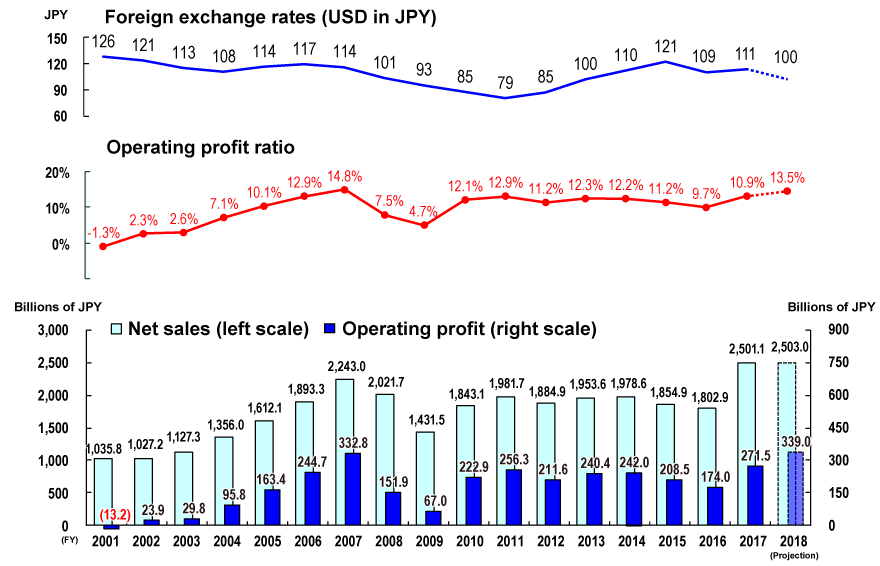

We believe our business of construction and mining equipment is a long-term growth industry. To look for long-term, sustainable growth in this core business of ours, we need a scenario which enables our financial growth, as we respond to not only customers’ needs, but also to social problems and requests at a high level, that is, with products, services and solutions equipped with totally new values.

SLQDC

Of all social issues, safety might come first. In the Komatsu Group, safety comes first. Even before becoming president, I have consistently emphasized the priority of SLQDC (Safety, Law, Quality, Delivery and Cost), when we decide on things. This order of priorities applies to all workplaces, including our production floors, suppliers and distributors.

- (1) Safety: Safety and physical and mental health at work and within families.

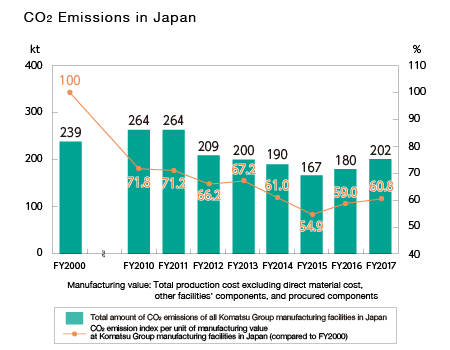

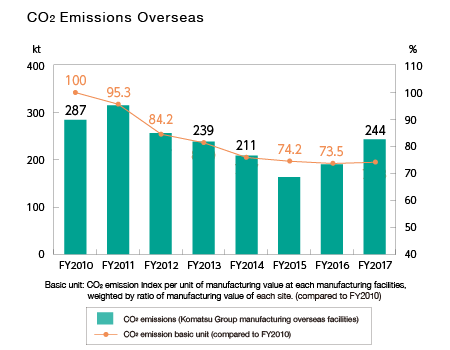

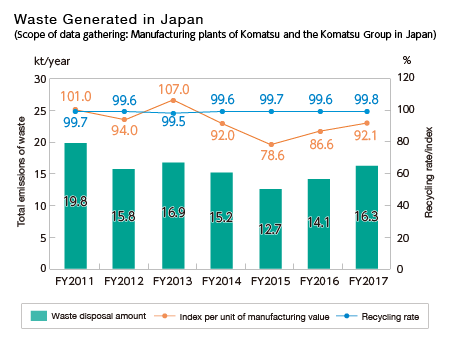

- (2) Law: Compliance with environmental regulations, laws and business rules in different parts of the world.

- (3) Quality: Maintenance and improvement of Quality and Reliability in products, services, and solutions.

- (4) Delivery: Setting up and keeping appropriate delivery dates.

- (5) Cost: Understanding costs and controlling them through continuous improvements.

When talking with many customers, I always feel their solid determination to achieve Zero Accidents in business. Jobsite safety is an essential value of all companies that they should achieve themselves, and for us it is also a shared value with society, which we must first provide to customers through our core business.

Creating Customer Value through Communication

By creation of customer value, we mean that we go inside customers’ jobsites, define what their jobsite operations of the future should be, identify real jobsite tasks through constructive communication with customers, and work to solve problems together with customers by making full use of our resources, including products, service and solutions.

By taking full advantage of ICT with our Autonomous Haulage System and SMARTCONSTRUCTION, for example, we can “visualize” jobsite information. Then we can discuss the data together with customers by asking ourselves the “whys” in order to define the ideal conditions that customers are working to achieve in the long range (what they should be like in the future) and to identify real tasks or differences from their ideal conditions of the future. These real tasks become “visible”, including not only safety (Zero Accidents) and improved productivity and efficiency, but also labor shortage, environmental protection, maintenance of biodiversity, sharing of the future with local communities, and improvement of diversity. Together with customers, we will place priority on these tasks and work to solve them.

As we deepen discussions with customers and build on improvements for real tasks, I believe it’s possible for us to spiral up solutions for social problems and customer value.

Management Principles

The cornerstone of our management principles is to maximize our corporate value through commitment to Quality and Reliability. We believe our corporate value is the total sum of trust given to us by society and all our stakeholders. I will ensure all employees share The KOMATSU Way. Further, we will become aware of environmental, social and governance issues more keenly than before, as we work to improve our business performance and move forward in developing corporate strengths while achieving social responsibility in a well-balanced manner.

On behalf of the Board, I would like to extend my sincere appreciation to all our stakeholders for your continuing support.