Jul. 30, 2020

Komatsu Ltd. (“Company”) (President and CEO: Hiroyuki Ogawa) and its consolidated subsidiaries (together “Komatsu”) have revised the projections for consolidated business results as well as cash dividend for the fiscal year ending March 31, 2021 (April 1, 2020 - March 31, 2021), which was undecided in the “Consolidated Business Results for the Fiscal Year Ended March 31, 2020 (U.S. GAAP)”, that Komatsu announced on May 18, 2020.

Reasons for the Revision

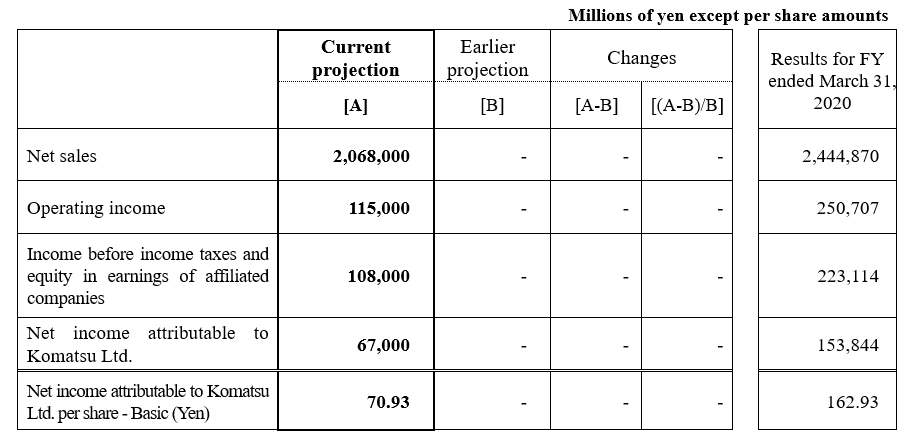

Concerning the projection for the fiscal year ending March 31, 2021, which was undecided in the “Consolidated Business Results for the Fiscal Year Ended March 31, 2020 (U.S. GAAP)”, which Komatsu announced on May 18, 2020, Komatsu has calculated the projections based on information and predictions which are available as of today, and is projecting a decline in both sales and profits as follows.

In the construction, mining and utility equipment business, Komatsu anticipates a decline in sales, reflecting reduced demand as affected by the coronavirus (COVID-19) pandemic. Komatsu expects demand will enter a recovery phase in the third quarter in the Traditional Markets*, and in the fourth quarter in the Strategic Markets*. With respect to China, Komatsu anticipates steady demand, as the post-Chinese New Year sales season was pushed back from February this year and the Chinese government has implemented measures to support the economy, such as infrastructure investment. Komatsu also anticipates that demand for parts and service will recover before equipment, based on KOMTRAX data which shows a recovery trend of machine operations on worksites. Concerning profits, Komatsu estimates a decline, mainly due to reduced sales volume, a change in the geographic composition of sales, and the Japanese yen’s appreciation.

In the retail finance business, Komatsu anticipates a decline in revenues mainly affected by a decrease in new contracts. Segment profit will fall mainly due to adverse effects of extension of payments and revaluation of vehicles after lease use.

In the industrial machinery and others business, Komatsu anticipates that challenging conditions will continue, such as a delay or curtailment of new capital investments in the automobile manufacturing industry. On the semiconductor market, however, Komatsu expects that demand will remain steady. As a result, Komatsu anticipates both sales and profits will increase.

As preconditions for its projection, Komatsu anticipates the foreign exchange rates will be USD1=JPY105, EUR1=JPY116, and RMB1=JPY15.0 in the second quarter through the fourth quarter, and assumes the average exchange rates for the full year will be as follows: USD1=JPY105.6, EUR1=JPY116.7 and RMB1=JPY15.0

Notes*: Markets as Positioned by Komatsu

Traditional Markets: Japan, North America and Europe.

Strategic Markets: China, Latin America, Asia, Oceania, Africa, Middle East and CIS.

Revision of Projected Cash Dividend

Reasons for the Revision

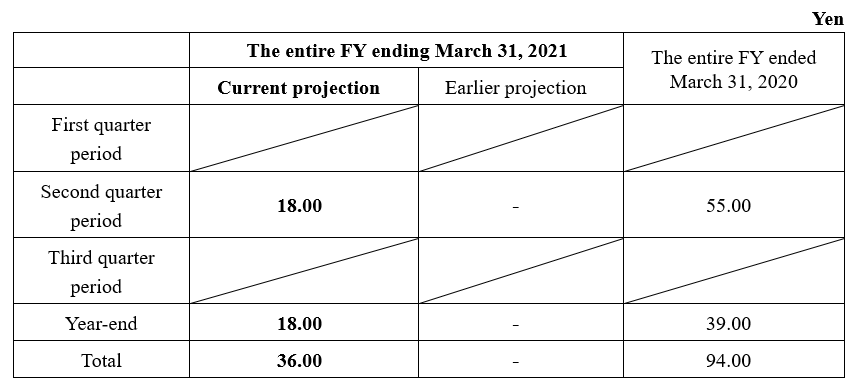

Komatsu is building a sound financial position and is enhancing its competitiveness in order to increase its sustainable corporate value. Concerning cash dividends, Komatsu has the policy of continuing stable payment of dividends after comprehensively considering consolidated business results and reviewing future investment plans, cash flows and the like. Specifically, Komatsu has the policy of maintaining a consolidated payout ratio of 40% or higher.

As described earlier in this announcement, Komatsu anticipates that demand will decline in all regions, except for China, mainly in the construction, mining and utility equipment business, as affected by the coronavirus (COVID-19) pandemic. Accordingly, Komatsu projects a decline in both consolidated sales and profits. Concerning the projection of cash dividends for the year, which was undecided in the “Consolidated Business Results for the Fiscal Year Ended March 31, 2020 (U.S. GAAP)”, that Komatsu announced on May 18, 2020, Komatsu plans to pay JPY 18 per share for the interim dividend and JPY 18 for the year-end dividend. This was based on the above-mentioned basic policy after considering consolidated business results, and reviewing future business prospects. Therefore, the annual dividends will total JPY 36 per share, a decline from JPY 58 for the previous fiscal year ended March 31, 2020, and the consolidated payout ratio will become 50.8%.

Cautionary Statement

The announcement set forth herein contains forward-looking statements which reflect management's current views with respect to certain future events, including expected financial position, operating results, and business strategies. These statements can be identified by the use of terms such as “will,” “believes,” “should,” “projects” and similar terms and expressions that identify future events or expectations. Actual results may differ materially from those projected, and the events and results of such forward-looking assumptions cannot be assured.

Factors that may cause actual results to differ materially from those predicted by such forward-looking statements include, but are not limited to, unanticipated changes in demand for the Company's principal products, owing to changes in the economic conditions in the Company’s principal markets; changes in exchange rates or the impact of increased competition; unanticipated cost or delays encountered in achieving the Company's objectives with respect to globalized product sourcing and new Information Technology tools; uncertainties as to the results of the Company's research and development efforts and its ability to access and protect certain intellectual property rights; and, the impact of regulatory changes and accounting principles and practices.

No : 0033(2964)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00mb_cc_department@global.komatsu

*The information described is at the time of presentation and may be subject to advance notice.