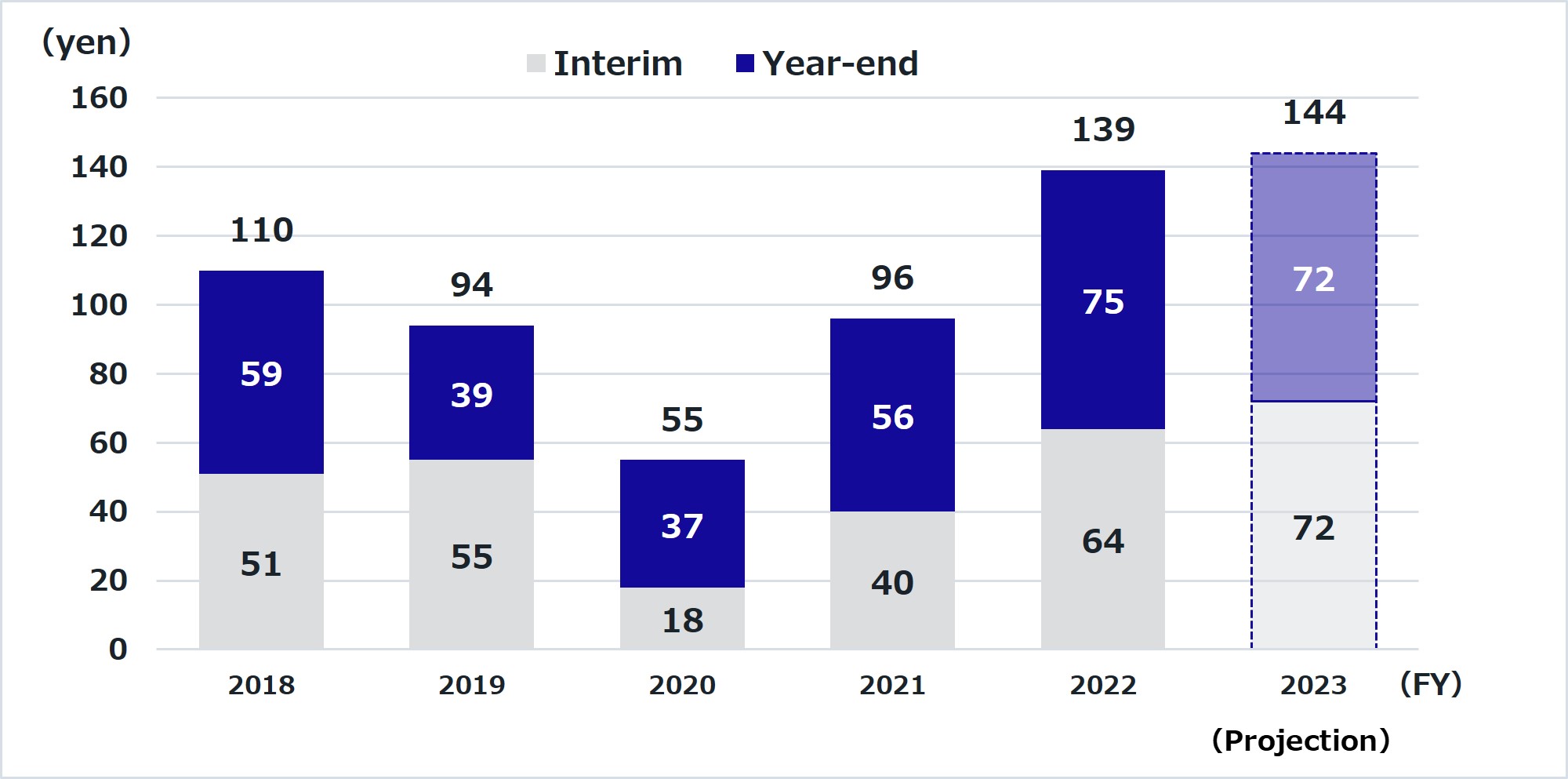

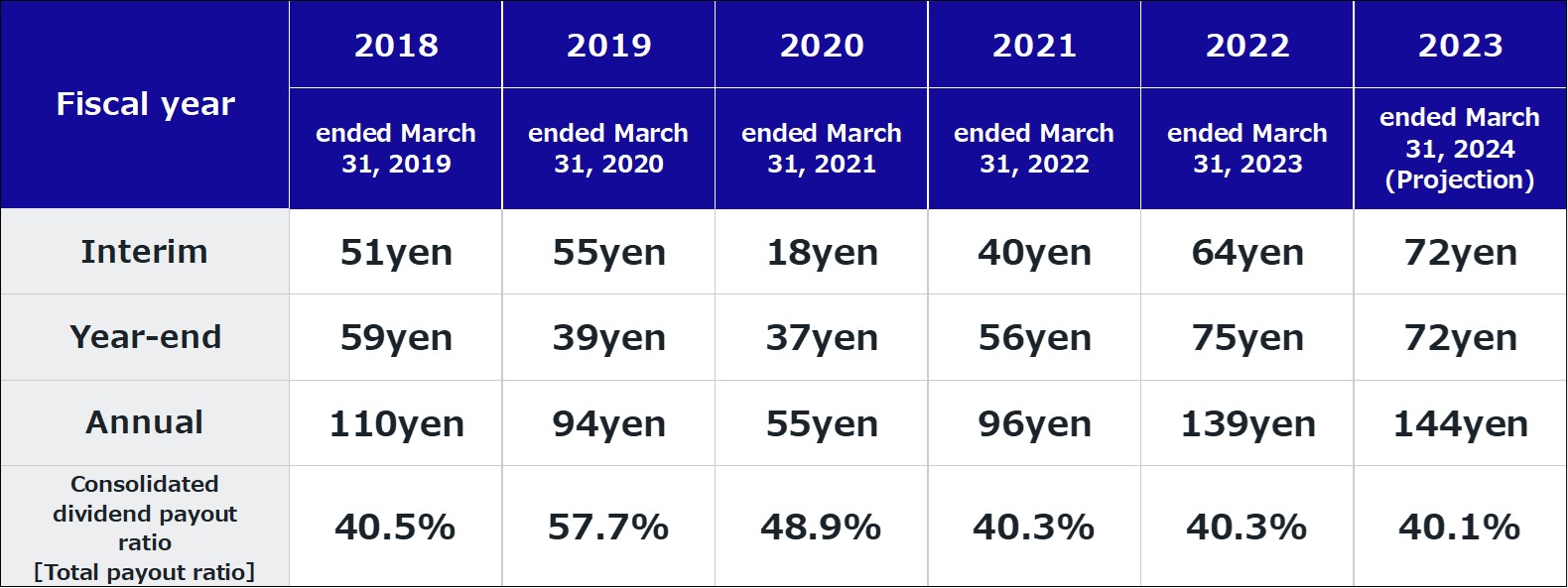

Komatsu is building a sound financial position and enhancing its competitiveness in order to increase its sustainable corporate value. Concerning cash dividends, Komatsu has the policy of continuing stable payment of dividends after comprehensively considering consolidated business results and reviewing future investment plans, cash flows and the like. Specifically, Komatsu has the policy of maintaining a consolidated payout ratio of 40% or higher.

*Cash dividends per share represent the amount based on the resolution by the ordinary general meeting of shareholders.

Note: Breakdown of the year-end cash dividend per share for the fiscal year ended March 31, 2021: Common stock dividend per share of JPY 27 and the 100th anniversary commemorative dividend per share of JPY 10