Apr. 26, 2018

Komatsu Ltd. today disclosed its consolidated business results (U.S. GAAP) for the fiscal year ended March 31, 2018 (FY2017) and announced projections for the fiscal year ending March 31, 2019 (FY2018). See below for a summary.

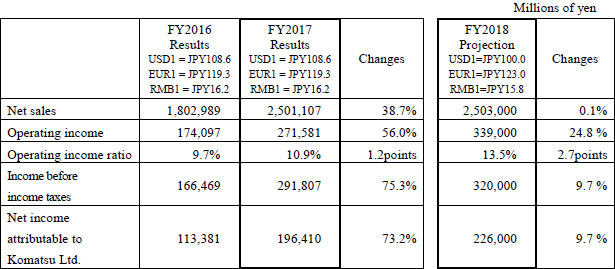

1. Results for the Fiscal Year Ended March 31, 2018 (FY2017)

For the fiscal year under review (April 1, 2017 - March 31, 2018), consolidated net sales totaled JPY2,501.1 billion, up 38.7 % from the previous fiscal year. In the construction, mining and utility equipment business, sales expanded sharply from the previous fiscal year, as Komatsu steadfastly capitalized on demand in China, Indonesia, and many other countries. Komatsu also benefited from the new addition of Joy Global Inc. (currently, Komatsu Mining Corp.), as a consolidated subsidiary, a leading U.S. manufacturer of mining equipment which Komatsu acquired in April 2017. In the industrial machinery and others business, sales declined from the previous fiscal year, mainly reflecting reduced sales of presses and wire saws, while sales of machine tools increased to the automobile manufacturing industry.

With respect to profits for the fiscal year under review, operating income expanded by 56.0% from the previous fiscal year, to JPY271.5 billion, driven by increased sales in many regions of the world, more than offsetting temporary expenses incurred in relation to the acquisition of the former Joy Global Inc. The operating income ratio improved by 1.2 percentage points to 10.9%. Income before income taxes and equity in earnings of affiliated companies climbed to JPY 291.8 billion, up 75.3%, reflecting a gain from the sale of investment securities. Net income attributable to Komatsu Ltd. totaled JPY 196.4 billion, up 73.2%.

2. Projections for the Fiscal Year Ending March 31, 2019 (FY2018)

In the construction, mining and utility equipment business, Komatsu anticipates that demand for equipment will stay firm, centering on Strategic Markets*. However, Komatsu estimates that sales will remain flat from FY2017, as affected by the Japanese yen's appreciation. With respect to segment profit, Komatsu expects an increase in spite of the Japanese yen's appreciation. This is because the adverse effects of temporary expenses incurred in relation to the acquisition of the former Joy Global Inc. should become smaller.

In the retail finance business, Komatsu estimates a decline in both revenues and segment profit, mainly reflecting the Japanese yen's appreciation.

In the industrial machinery and others business, both sales and segment profit should improve, because Komatsu anticipates an increase in sales volume of both presses and machine tools.

As preconditions for its projection, Komatsu is assuming the foreign exchange rates as follows: USD1=JPY100, EUR1=JPY123, and RMB1=JPY15.8.

Notes: Markets as Positioned by Komatsu

Traditional Markets: Japan, North America and Europe

Strategic Markets: China, Latin America, Asia, Oceania, Africa, Middle East and CIS

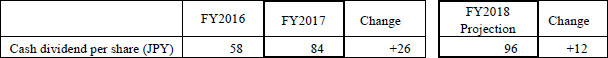

3. Cash Dividends

Komatsu Ltd. is planning to set the fiscal year-end cash dividend at JPY48 per share. As a result, annual cash dividends for the year under review, including the interim cash dividend of JPY36 per share, amount to JPY84 per share. (Komatsu Ltd. is planning to propose the fiscal year-end dividend amount to the 149th ordinary general meeting of shareholders scheduled for June 19, 2018.)

Regarding annual cash dividends for the fiscal year ending March 31, 2019, the Company plans to set them at JPY96 per share, an increase of JPY12 per share from the fiscal year ended March 31, 2018.

No : 014 (2760)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00mb_cc_department@global.komatsu

*The information described is at the time of presentation and may be subject to advance notice.